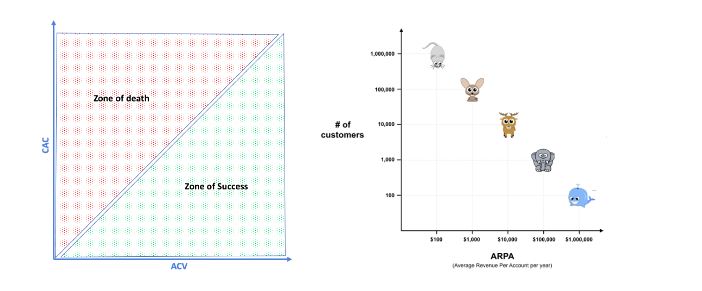

Six years back, almost to the date, I drew a graph between CAC (Cost of Acquiring a Customer) and ACV (average Annual Contract Value) for SaaS companies. This was part of a presentation I made to the partnership at Helion to emphasize the point that ACV by itself is not important – what is important is its correlation to CAC. As long as the two are correlated, you can build a company anywhere on that curve. I had not seen the famous elephant or the whale chart by then. Both versions are reproduced here.

I was partially right, but mostly wrong.

A few months back, I was sitting at SaaSBoomi Enterprise, where some of the best SaaS founders were sharing their journeys with earlier stage entrepreneurs. No matter what the topic of their presentation was meant to be, all of them had one central theme – they had all moved upmarket through their journey. To put it differently – no matter where they started, they all aspired to move in the direction of elephants and eventually whales.

Why?

For a moment, ignore account expansion. This will mean that you will need to add 420 new customers in the next 12 months. With an average sales productivity of $250K per AE, this would mean that you have 8-9 AEs (and possibly the same number of SDRs and CSRs). For a 20% closure rate from qualified lead to sales and 15% ratio of lead to qualified lead, this will mean an addition of 14,000 leads to your pipeline.

Now let’s move to the next year, this time, you need to add a staggering 6.3M. All variables being what they are, the math multiplies linearly. You will need to have 25-26 AEs (which may mean you will need to hire twice as many as only 50% will work out). You will need to create 42,000 new leads. Even if you grow 2.5x the next year, this math becomes intractable.

The astute reader may argue that there are large companies like Shopify and Freshworks that have been built at low ACV. But I have a few things to say:

- You can scale the math if you are marketing driven (like Shopify), and not sales driven. Marketing can scale. Sales cannot, at least not in a linear fashion. Intuit has also done this well in the past, and so have companies like Dropbox, Atlassian, Slack.

- No matter who you are, at some point the math will still fall apart, and you have no choice but to move upmarket. Dropbox and Atlassian today have enterprise sales teams, and to my knowledge, so does Freshworks.

- Even sometimes when you do not want to, your customers will grow and force you to go upmarket. They will want multi-currency capabilities, persona-based dashboards, security certifications, audit trails, admin capabilities…

- Also, you are not the same small company with meagre resources that you were. You will not die now because of one expensive sales cycle. You have more credibility – more cash on the balance sheet, and better customer references.

- Finally, it is hard to argue against the economics of selling to larger customers – a lot of your growth will come from existing customers, you will collect cash for multiple years sometimes after the sale, and net dollar churn will likely be negative.

Net net, my point is that unless you have a purely marketing driven customer acquisition, you will need to move upmarket. You will need to go to elephants at some point and then to whales. You do not have a choice. When you need to do it, and how you do it, will almost certainly differ, which is a discussion for the next post.

As always, I know that many of you disagree, and would love to hear your thoughts on alok@stellarisvp.com. Those who agree are welcome as well!