As a founder, you’re constantly juggling the demands of innovation, management, and strategic growth. In the whirlwind of startup life, board meetings can either be a source of tremendous value or a dreaded calendar event.

That’s why we’re introducing the Board Code — a guide for founders to leverage their board meetings.

The purpose is clear: to make board meetings less about mundane updates and more about strategic decision-making, realignment, and actionable feedback. Whether you’re preparing for seed round discussions or steering through Series A and beyond, this asset is your blueprint for conducting board meetings that are informative and instrumental in propelling your company forward.

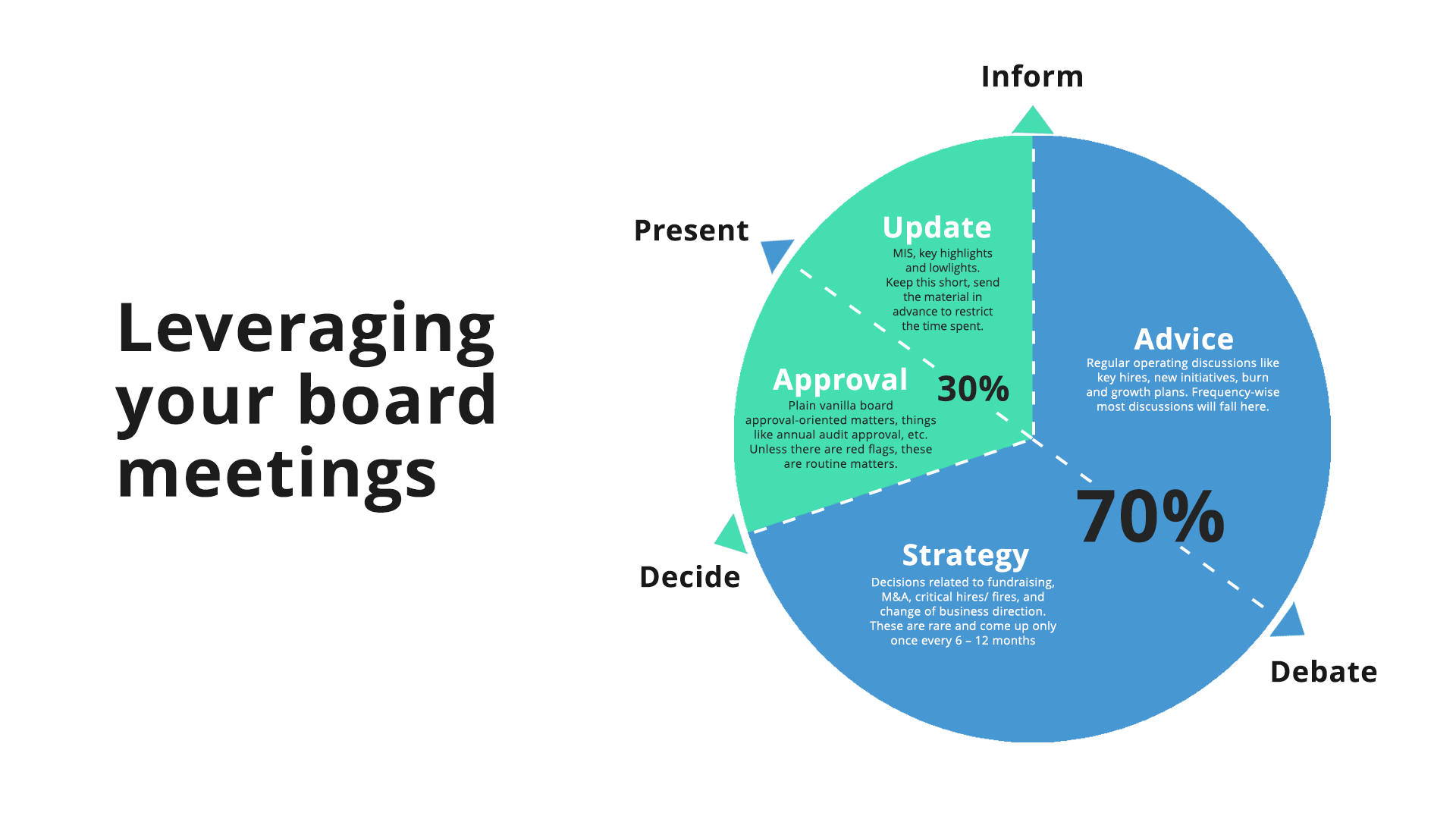

Board meetings are strategic platforms that can shape the future of your startup. Drawing from Mark Suster’s insightful framework, we’ve distilled the essence of board meetings into four core quadrants: Advice, Strategy, Update, and Approval.

While it may seem counterintuitive, about 70% of your board’s discussions should center around Advice and Strategy. Advice is the board’s forte, sought at virtually every meeting, where the collective experience of the board can guide operational decisions. Strategic discussions may not occur as frequently—typically once a quarter or biannually—but they are the pivotal moments where critical decisions regarding fundraising, mergers, or key hires are debated.

The remaining 30% of the board’s time should focus on Updates and Approvals. Updates provide a quick synopsis of the company’s key highlights and lowlights, ideally pre-discussed to ensure the meeting remains focused on moving forward. Approval, though less frequent, is equally vital, dealing with essential governance items such as annual audits. These should be approached as a clear-cut, no-fuss process.

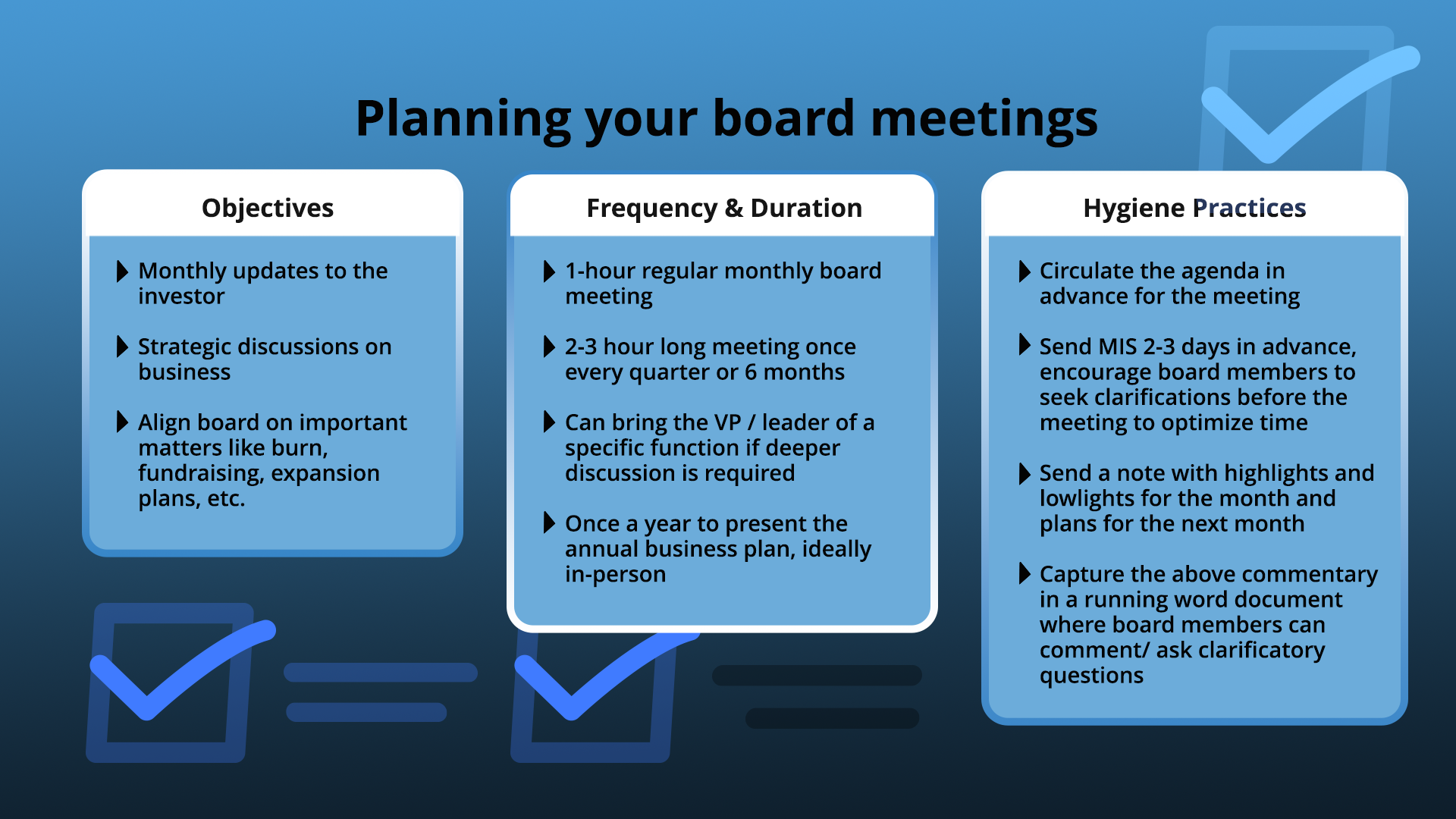

Timing is key—monthly meetings should be concise, limited to one hour to maintain a steady operational tempo. Quarterly or biannual gatherings allow for more in-depth explorations of complex issues, possibly bringing in insights from a VP or a department leader. The annual meeting is set apart for a thorough review, presenting the business plan in full detail.

To ensure these meetings run effectively, it’s vital that board members receive the agenda and relevant documents, like theMIS reports, well in advance. This allows them to digest the information and seek any necessary clarifications ahead of time. Post-meeting, a summary of the outcomes and a look ahead prepares everyone for the next steps. Maintaining an ongoing document for comments and questions encourages continuous communication and alignment.

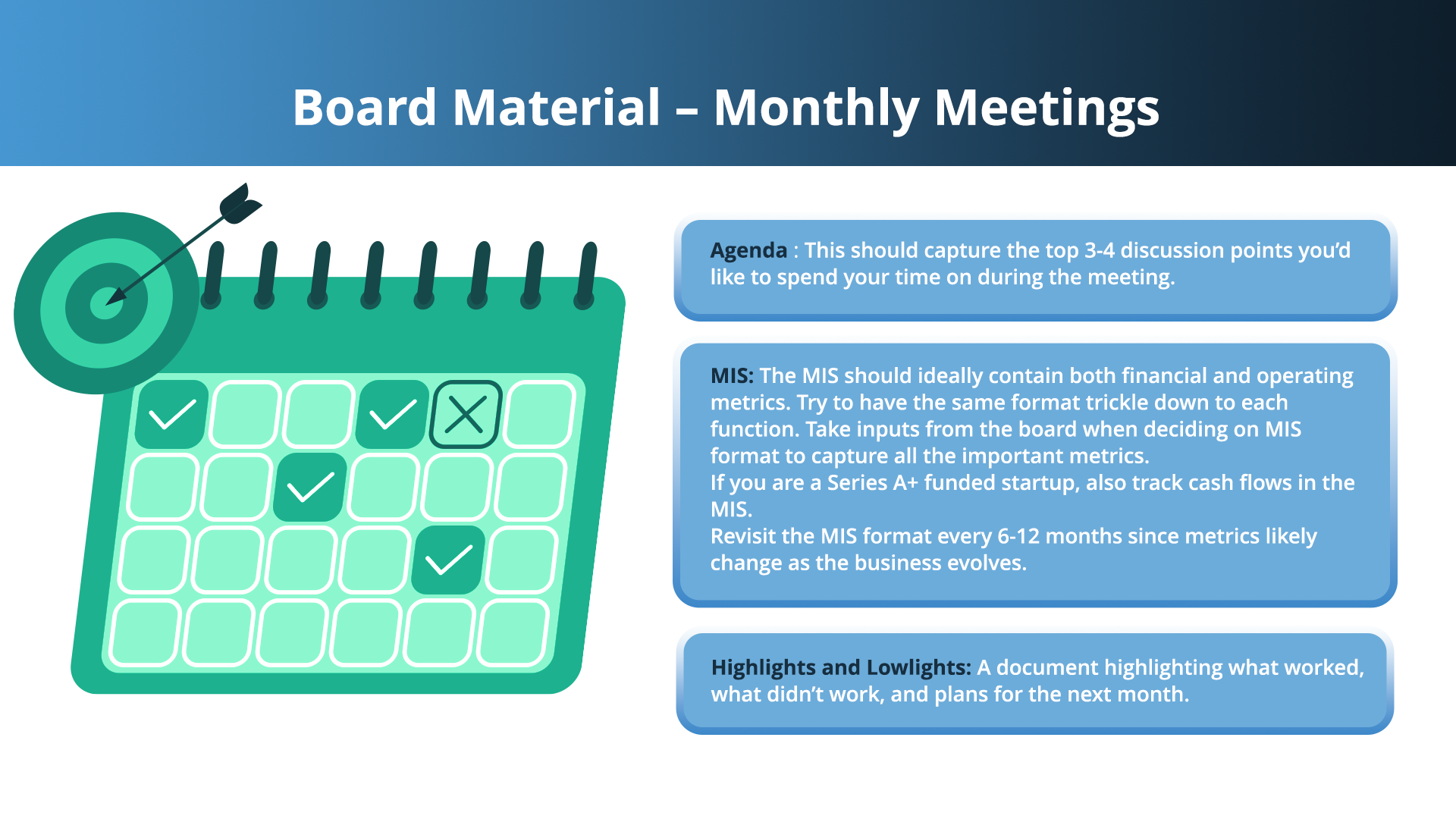

Diving into the monthly board meeting, the focal point is the board material, which anchors the discussion and decision-making. Central to this is the agenda, honed to spotlight the 3-4 most critical topics for discussion, ensuring that the meeting’s attention is sharply focused.

The MIS report is the next piece of the puzzle, offering a comprehensive view of both financial and operational metrics. It’s essential to standardize the MIS across all company functions for consistency and to include the board in shaping its format, guaranteeing it reflects the metrics that will inform key decisions. For growth-stage startups, monitoring cash flow within the MIS is non-negotiable. Given the fast-paced evolution of startups, the MIS should be reviewed and revised semi-annually to remain relevant.

The meeting’s narrative is completed with an honest overview of the company’s highlights and challenges, setting the stage for an open dialogue. This narrative arc aligns the board with the company’s trajectory and charts a clear path forward. The materials for a monthly board meeting are thus a streamlined set of documents that guide focused conversation and strategic alignment, paving the way for informed and decisive action.

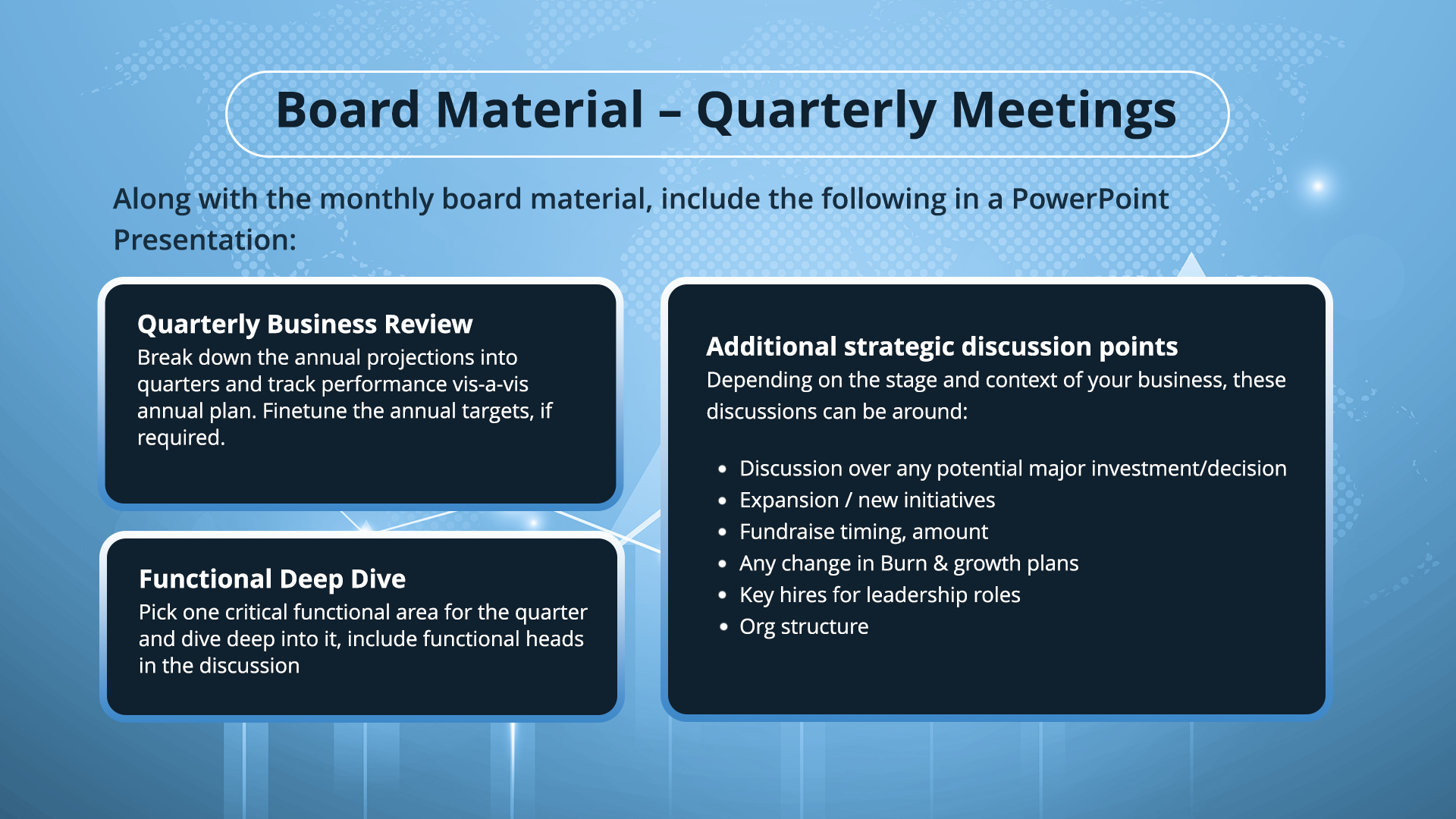

Quarterly meetings take a magnifying glass to the company’s progress with the Quarterly Business Review (QBR) at their core. This isn’t just a retrospective look but a rigorous, detailed examination of how the company’s results stack up against the projections set out at the year’s start. It’s a strategic pause for assessing alignment with long-term goals and adjusting course if necessary.

These sessions are fertile ground for strategic dialogues — decisions made here have the potential to chart new courses for the company. Major investments, new initiatives, fundraising timelines, and critical financial adjustments are on the table. It’s also the time to scrutinize the company’s organizational structure, considering changes that could optimize performance.

The Functional Deep Dive is an integral feature of these meetings, offering a focused look into one specific area of the business. This granular analysis helps the board grasp the intricacies of the company’s operations, shining a light on areas that require closer attention or immediate action. These quarterly meetings are thus designed for insight—empowering the founders to make decisions that are both informed and impactful.

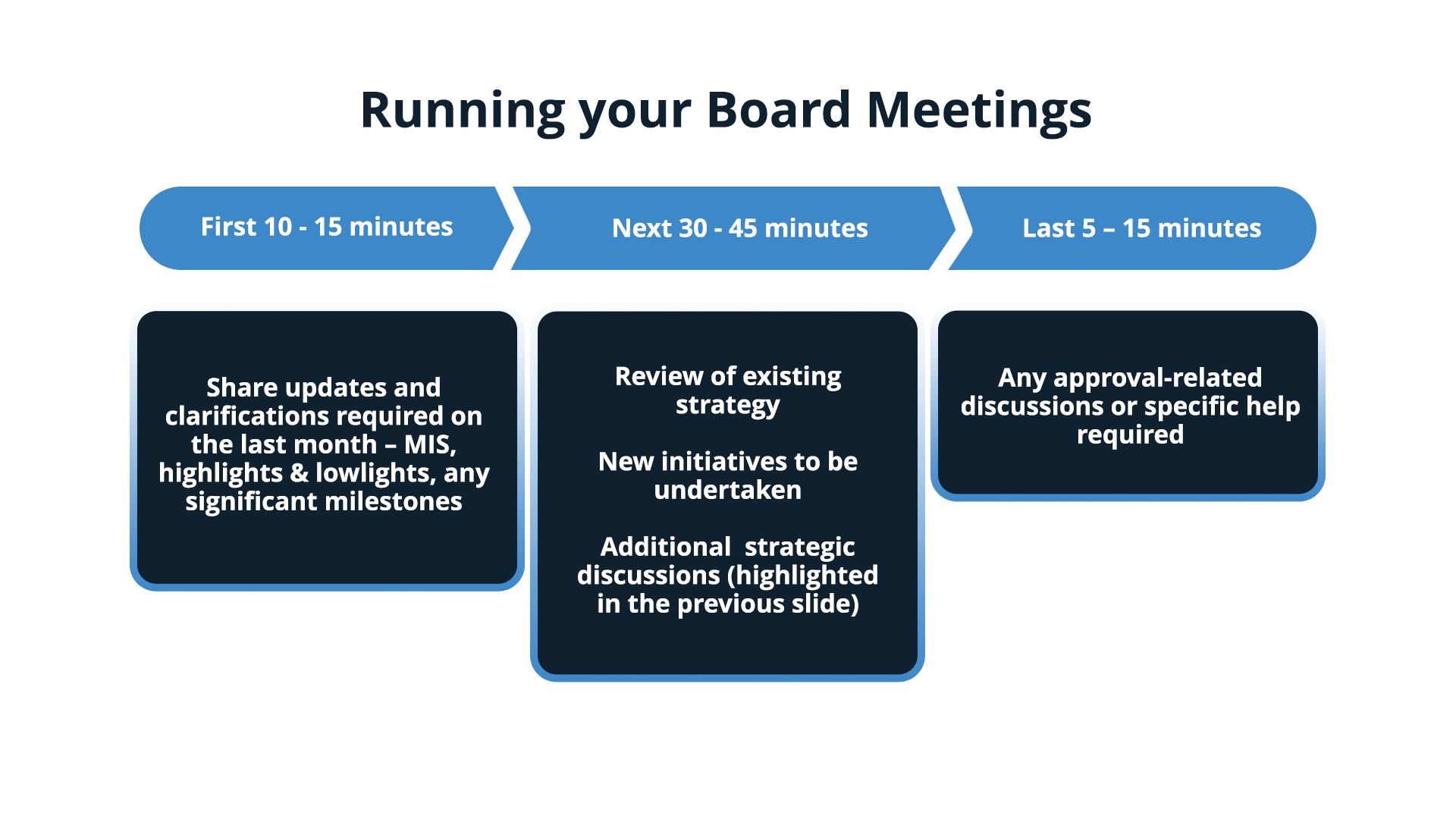

In orchestrating board meetings, timing and structure are paramount. The approach is methodical: divide the meeting into three distinct segments, each with a purposeful agenda to maximize efficacy.

Kick off with an expedient 10 to 15-minute update phase. This brisk segment is where the Management Information System (MIS) reports are tabled, along with a recap of the highs and lows from the previous month, and acknowledgment of any significant achievements. The objective here is swift alignment, setting a unified starting point for all members.

Transitioning into the heart of the meeting, the next 30 to 45 minutes are reserved for strategic evaluation and ideation. This is the crucible of the meeting, where existing strategies are scrutinized and potential new initiatives are explored. Additional strategic discussions, as highlighted in previous sections, come into play here, fueling the collective brainstorming that is essential for informed decision-making.

Concluding the session is a concise 5 to 15-minute segment dedicated to approvals and addressing specific support requests. This closing act ensures that any pending matters are addressed, decisions are ratified, and actionable tasks are clearly assigned, setting a definitive course for the period ahead.

This tri-segmented structure is the framework within which board meetings unfold—focused, energetic, and result-oriented, guaranteeing that each minute is leveraged towards guiding the company’s strategic direction.