The last place to go looking for startup opportunities is probably the periodic table, yet there might be gold between the hydrogen and helium pieces if you look closely enough.

The 6th largest chemical producing country globally, India is home to a $200B+ chemicals industry which is growing 10% annually. Chemicals is one of the largest export categories for India, and half of that is constituted by specialty chemicals alone. Specialty chemicals, unlike commodity chemicals, are low-volume and high-value products which are sold based on their quality or the utility they add to the performance of end-product, rather than their composition. Specialty chemicals in India alone is a ~$32B opportunity, growing 11% YoY, globally it’s an $800B+ market.

For the scope of this article, our commentary is going to be focused on the specialty chemical export market only.

India is a net exporter of specialty chemicals, exporting $16B worth of its production. The US, Europe, China, and Brazil form a large part of demand from India today. Turkey, Russia, Hong Kong, and Korea are some of the emerging buyer nations, where new supply chains are getting built.

Still, India’s contribution to global specialty chemicals exports is meagre at best, at 3%. China, on the other hand, single-handedly contributes to more than 25% of world specialty chemicals exports, followed by the US and Europe. A power shift seems to be in order, and the timing couldn’t be better!

For one, India is emerging as the preferred manufacturing destination with “China+1” sentiment nudging large buyers to cost-efficient markets with strong technology capabilities like India. Stringent environmental regulations and increased cost of labour have already stifled growth in China. Europe is facing headwinds too as EU suppliers are becoming price uncompetitive owing to ESG adherence.

Closer to home, the government incentivising the sector with an expected Rs. 10,000cr+ PLI push presents a massive secular tailwind. Corroborated by the data, the sector has seen the highest % private capex spend among all other sectors in FY23. The growth of end-user industries such as hygiene products, textiles, personal and home care, and nutraceuticals is another positive trend.

Now that we know “why now”, let’s move on to “why at all”

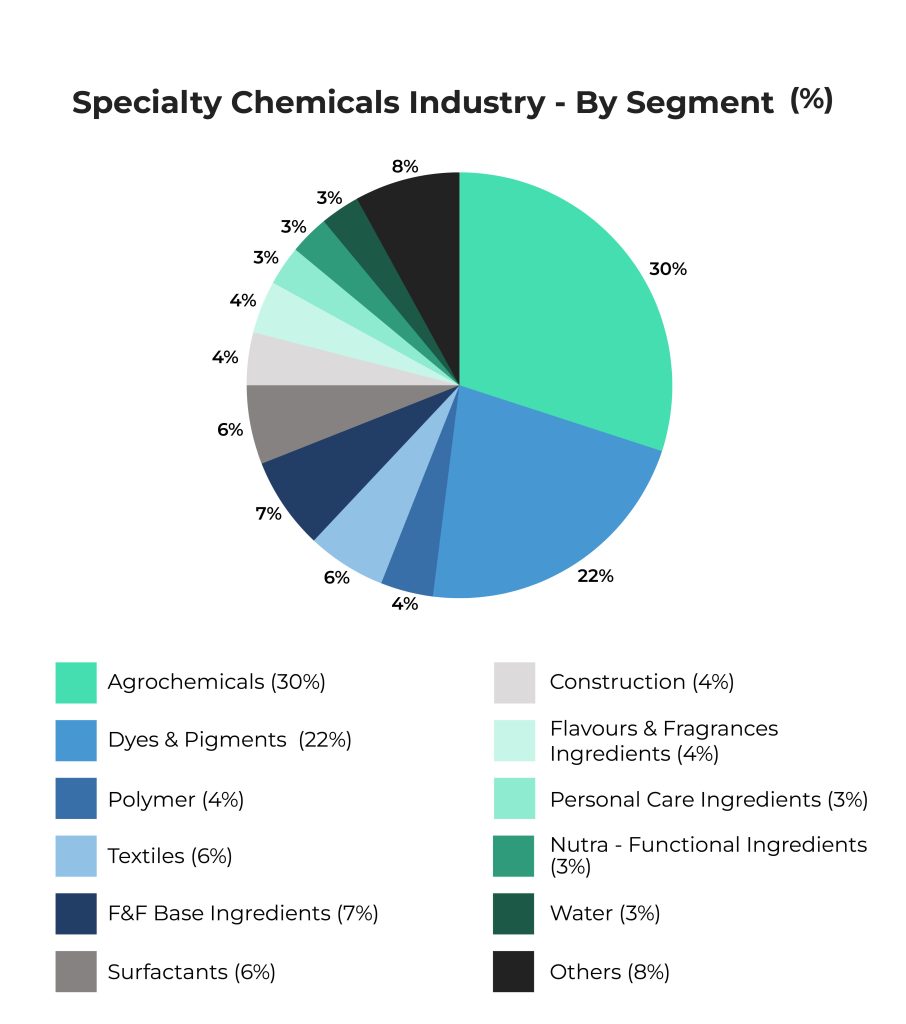

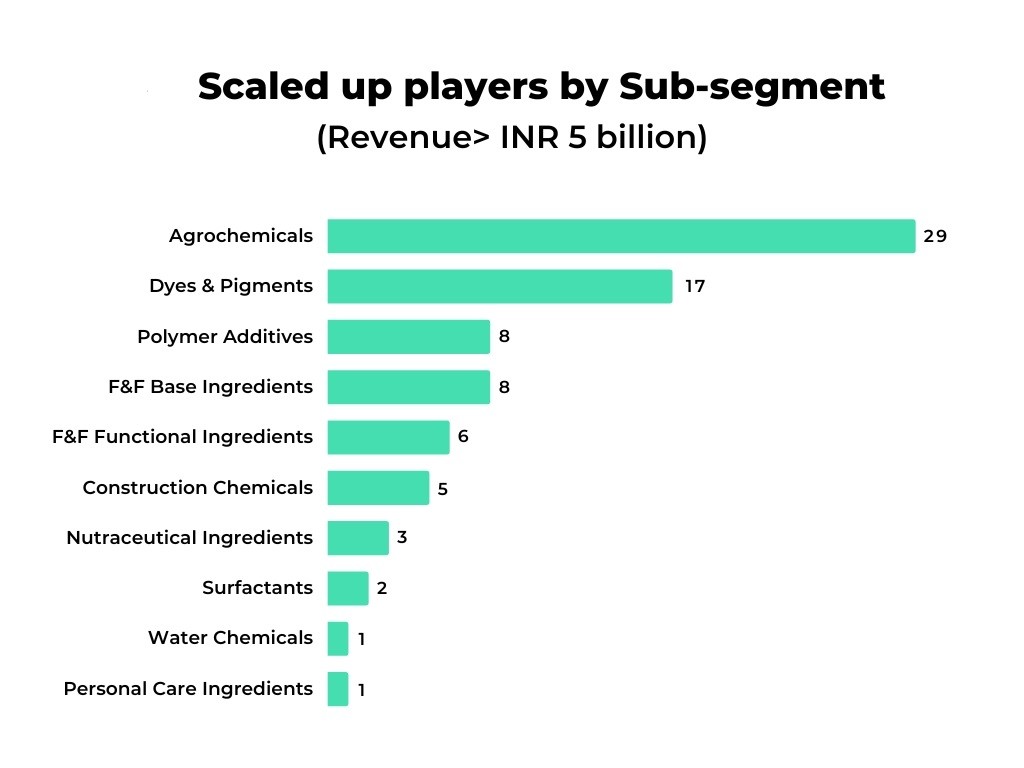

The industry is not only large and growing, but it is also quite fragmented, with most sub-segments having only a handful of scaled-up players (see image below) and a long tail of small suppliers, yearning for market share in domestic and global demand. Top 10 chemical manufacturers in the domestic market command less than 10% market share.

And it comes with high entry barriers – hence, scale becomes a moat. Involvement of complex chemistries in manufacturing, sticky vendor relationships because of long and expensive process of changing a vendor once recognised in regulatory filings, adherence to compliance norms to be enlisted as a supplier, capital intensity and ability to extend credit to customers all make it tougher for a new player to enter, and easier for the existing large players to retain their share.

Where, then, is the opportunity?

Given that most of the export demand is fulfilled by large suppliers who have both the benefit of scale and quality assurance, small suppliers struggle to capture a share of that large and profitable pie. Both identifying international buyers and supplying quality products to them are muscles that small suppliers simply don’t have.

As we know, entrepreneurs don’t stand on the sidelines when they see a deep problem in a vast value-rich market.

We’re seeing quite a few great teams building cross-border B2B chemicals marketplaces for international mid-to-large sized formulators (buyers) and small Indian manufacturers (suppliers). Most of these marketplaces focus on a specific sub-segment, to start with, like dyes & pigments, agrochemicals, etc.

In India, large suppliers exist in certain chemistries/ sub-segments of specialty chemicals, but not all. For instance, Aarti Industries is a large player in benzene & toluene chemistries while for segments like resins, aromatics, food flavouring etc. there is a long tail of manufacturers.

We did primary conversations with key stakeholders in the supply chain to understand their pain points and see where a middleman can add value. Here’s what we uncovered.

Discovery of suppliers for small-to-mid-sized buyers

Medium and small buyers of specialty chemicals don’t always have pre-existing relationships with suppliers, and are looking for easier ways to find them, especially in international markets. We believe this demand is sizable. Add to this, the demand from large buyers looking to build new supply chains to transition out of existing supply geographies (say, China) or to enter new formulations. Also, while supply chains between large markets like the US, Europe and India are well established, there are countries in the early stages of building their supply chains with India like Indonesia, UAE, Turkey, Russia, Macao, Korea, etc. where a facilitator can add huge value.

Unlike most other B2B marketplaces where primary TG is large buyers, for specialty chemicals, that might not be the case. Large buyers aren’t always looking for discovery of suppliers as they care about quality the most, and are ESG conscious. They prefer to work with trusted suppliers, with whom they have built long-term relationships. Once supply chains are established, it’s inefficient to disturb them, unless there are new material requirements or new geographies need to be entered. Also, large buyers have procurement teams with tech chops, to acquire trustworthy suppliers after stringent checks and physical visits (most global companies have their offices or representatives in India).

Export-readiness capability for small suppliers

Demand generation is an important value prop for the small supplier, as established previously. However, once discovered, servicing those buyers is a bigger issue. Most of the suppliers that we talked to are able to export little to no part of their production. A player can backward integrate with a network of small suppliers and get them quality-approved & ESG-adhered, expand their R&D muscle for product innovation, and provide them working capital financing to make them export-ready.

Of course, it is tough and expensive for a third party to ensure quality from small manufacturers in India, primarily because of their high-cost structures and largely manual operations.

The industry can also prove testing to an economically viable business model. One, it has long sales cycles because the complex product characteristics require longer evaluation time — 6 months to 3 years — before a buyer can finalise a supplier. Two, long working capital cycles that can stretch up to 60 days. Large order values, and attractive margins in specialty chemicals, however, do provide some comfort.

Deep pain points present large opportunities and create massive outcomes if solved efficiently and economically. We, at Stellaris, are excited to meet entrepreneurs building in this market. Creating a channel of discovery and quality-assured fulfilment can be massively value-creating, both for suppliers and buyers while fetching the facilitator attractive margins in the process.

If you’re a founder, investor, operator, or enthusiast in this space, please write to rupali@stellarisvp.com and we can talk!

Our B2B Commerce team: Mayank Jain, Naman Lahoty, Rahul Chowdhri, Rupali Goel