Era Jain & Anagh Prasad, July’21

Dev-software, i.e. products that are sold to, purchased or influenced by, and consumed by software developers, is a $40B+ market today, accounts for 7% of the global software spend and is growing at 19% CAGR. As every company becomes a software company, the amount of software created is expanding at a frenetic pace, aided by cloud computing, APIfication and agile development cycles. This push towards making software a core competency has also fueled the growth of the global software developer population, which is expected to reach 45M by 2030. Given this growth, focus has shifted significantly to the needs of the developer – the lynchpin factor of production for software! As a matter of fact, 70% of Dev-software companies are B2D or developer-centred companies whose products are being adopted in an increasingly bottoms up fashion.

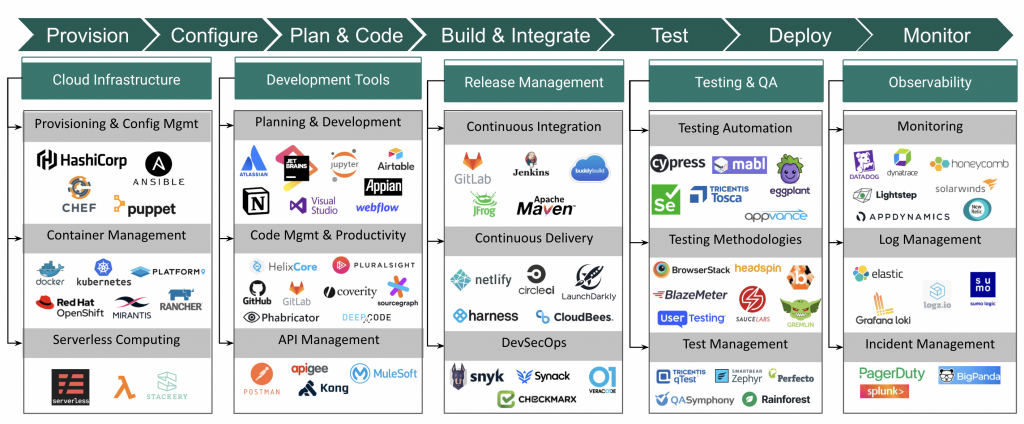

At Stellaris, we are excited about companies capitalizing on the above theme. Our framework for the market is derived from the typical lifecycle of software development in a developer’s daily life.

What is changing in the industry?

Dev-software is a dynamic and often turbulent ecosystem that’s been witnessing unprecedented evolution since the advent of cloud and advancements in distributed computing. The past decade has seen a massive shift from fragile, hard to scale monolith applications towards disaggregated, modular, microservice based architectures that has improved scalability but has made enterprise stack more complex than ever. The continuous rise in consumer demand for latest software has been constantly pushing organizations to adopt agile development practices and is breaking silos between developer, testing, security, and operations functions.

We are excited about the following trends and the resultant opportunities for building the next set of large Dev-software companies:

1. Open source adoption:

The rise of open source software (OSS) is driven by other strong undercurrents in technology. Firstly, OSS is often no longer being seen as a cheaper version of its closed source counterparts, rather a superior alternative that leverages the collective power of the community to offer new functionalities, higher quality libraries, better/faster support and increased flexibility/adaptability. Secondly, purchase decisions for tools and infrastructure continue to shift to developers – most of whom come with strong affinity towards tech egalitarianism. 70-79% of developers report having significant or complete influence over purchase decisions, leading to unprecedented adoption of OSS for critical functions.

The open core business model, wherein a company keeps the core functionality open-sourced but charges for premium enterprise-grade add-ons, is fast emerging to be the most promising and sustainable business model for OSS startups; recently proven by commercial success of companies like Mulesoft, Elastic, Sentry and Databricks.

2. Dev-time is more prized than ever:

Shortened development cycles have increased the demand for tools that speed up software development processes. Developer productivity tools are growing the fastest within Dev-software, having raised $7B in Venture Capital funding in just the last two years.

Growing codebase and growing engineering teams warrant tools that allow for fast code discovery and navigation across hundreds of repositories. Code search, pioneered as an internal tool by Google and Facebook, was democratized by Sourcegraph, now a market leader in code search and discovery. An emerging theme in this category is “search everything”. Companies like Raycast and CommandE are focusing on bringing back the developer time lost navigating workspaces cluttered by a growing number of tools, widgets and files.

Assessing developer productivity and aligning it with key business objectives is hard due to lack of standardized engineering productivity metrics, and organizational silos that IT and business teams have historically operated in. Companies like Pluralsight and LinearB give insights into the engineering workflow, and metrics that quantify impact and keep engineering teams aligned with business priorities.

3. Rising complexity of cloud-native applications is driving innovation in DevOps:

Current cloud-native adoption rate stands at 40% and is growing fast. Unlike cloud-enabled applications, which are on-prem monolith applications modified to be deployed on the cloud, cloud-native applications are built to embrace a microservice architecture. Proliferation of microservices and a rising demand for faster and scalable deployment capabilities is creating opportunities for new players in various ways.

The elastic resource consumption in containers, that is the ability to scale up or down, has made provisioning-at-scale quite important. Hashicorp’s Terraform and Pulumi let developers automate infrastructure provisioning through code (IaC). Serverless Computing, pioneered by AWS Lambda, where resource provisioning is fully automated and managed by cloud providers has become quite popular – Serverless and Stackery are few emerging players.

As engineers shift from releasing monoliths to releasing dozens of microservices, we are seeing a “shift left” in CI/CD. In this developer-centric devops approach, software quality is continuously assessed during early stages of development with the help of static code analyzers (DeepCode, Coverity, DeepSource), continuous testing tools (Sealights, Blazemeter), prod-preview environment enablers (Quali, Release) and feature-flag deployment tools (LaunchDarkly, Split). There’s also an increasing adoption of GitOps with a Git repo replacing the CI/CD pipeline and serving as the single source of truth for application and infrastructure code.

Distributed Tracing has become vital for observing cloud-native applications. Astradot, Axiom use next-gen databases to store a request’s path and retrieve terabytes of traces and logs blazingly fast. We are also seeing next-gen debugging platforms like Lightrun arising out of the need to simply debugging microservices when reproducing prod environments is not straight-forward. Popularity of serverless has created new opportunities in the observability space (Dashbird, Thundra) due to the challenges involved in monitoring applications whose underlying servers are not accessible by developers.

4. Emergence of API dedicated tools as the world moves towards an API-first culture:

Microservices and serverless models have led to a massive disaggregation of applications and given birth to an API-first culture in software development. In the next 20 years, the number of programmable endpoints will have grown from billions to over a trillion.

With these exploding endpoints, API management tools are becoming critical for every organization – Postman’s collaborative platform simplifies API development and testing, APIMetrics addresses the challenges with monitoring APIs in production, Apimatic and Optic help developers maintain accurate API documentation.

API marketplaces like Rapid API are becoming popular in the developer community. While they benefit the consumer who saves development time by incorporating pre-built components in their application, they also benefit the developer by enabling discovery and monetization. We are seeing early signs of vertical APIfied marketplaces; e.g., HuggingFace in Natural Language Processing.

With the rapid growth of omnichannel experiences, backend development often fails to keep up with the pace of frontend development. We are also excited about the opportunities in the API-driven headless or decoupled systems for content management that will simplify and accelerate backend development (Nhost, Strapi).

5. Low-code/No-code tools are simplifying development processes:

While technology has continued to evolve rapidly, the global demand for skilled IT personnel has outpaced the supply – 87% of companies today are either facing IT skills gaps or expect them to emerge over the next few years. Low code platforms empower organizations to jumpstart their digital transformation while meeting their agile objectives even with a deficit of technical employees. The global low-code/no-code platform market revenue was valued at $13B in 2020 and is expected to reach $65B in 2027.

The no-code/low-code movement will expand the global pool of developers by opening up dev-access to non coders, aka “Citizen Developers”. We believe that these platforms will not only see adoption by business and product teams who want to create simple consumer-facing apps using pre-built templates and automate workflows with zero coding (Airtable, Unqork, Zapier, Airkit), but also by traditional developers who are seeking ways to automate redundant tasks and reduce time spent in building tools that are internal or non-core to the organization (Retool, Buildbase, Axiom)

6. There is a “shift to the left” in security:

Security testing is no longer a siloed task performed by security engineers towards the end of development rather a core focus during development, leading to a rapid growth of DevSecOps. Snyk, ZeroNorth, Sken, Atomist are few emerging companies that make continuous security a part of the agile development process. Cloud-native architecture poses unique security risks and is driving innovation in this space. For example, security scans have expanded beyond detecting vulnerabilities in the application code to IaC and container images. Security-as-a-code that enables developers to implement guardrails in CI/CD pipelines and proactively prevent risky commits is seeing increasing adoption.

We are also excited about the advancements in security testing from legacy heuristic-based approaches to new age methodologies such as AI-based DAST (NeuraLegion) and crowdsourcing platforms (Synack, Bugcrowd, Federacy), the merging of observability tools for application security and compliance, security event incident management into APMs (Deepfactor, Inspectiv, Vulcan, AlertFusion) and the code-risk platforms addressing asset discovery and risk visibility in cloud-native architectures (Lucidum, Apiiro).

7. AI is penetrating dev-tools

Advances in data infra tools have led to the ability to store massive amounts of data for all stages of the dev cycle, from development (commits, reviews, documentation) through production (logs, metrics, traces, incident reports). Therefore, along with increasing sophistication in ML algorithms, we are now seeing AI penetration and opportunities across different stages of SDLC.

Smart IDEs (Tabine), AI-based code review tools (Metabob) and predictive code health tools (DeepCode.ai) use ML models trained on past commits and bug fixes to provide auto code-completions, recommendations for better code quality, identify hard-to-find bugs and auto generate code fixes.

AI is bringing continuous testing closer to autonomous testing. Deep learning driven testing tools are shifting testing to the left, expanding automation beyond execution into test generation and maintenance. NLP and Vision AI technologies will enable test generation directly from test flows in plain english or mockups even before any code is written. These types of tools – Tricentis Tosca, Walrus, Perfecto, Eggplant are few such examples, will eliminate the need of writing complex automation scripts, and make testing reliable as the scripts will update automatically with the application. We also expect to see application of AI in QA optimization such as determining which tests to run based on the commit instead of running the entire suite (Appsurify, Launchable), simulating test cases by learning from live user data (ProdPerfect, Testgram), and mimicking production data to generate realistic test data (Tonic).

Next-gen observability tools use AI to optimize applications based on their run-time behavior, auto-detect anomalies, proactively prevent breakages and outages, and remediate issues automatically without much human intervention (Granulate , Sosiv, Gavel).

Over the last 12 months, we have had the opportunity to meet many exciting teams within Dev-software, and are very encouraged to see both the quality as well as the number of entrepreneurs. With India slated to have the largest number of developers globally very soon, we expect India to be amongst the largest consumers of Dev-software as well.

If you’re building a global Dev-software product from India or would just generally like to brainstorm ideas with us, our inboxes are always open at alok@stellarisvp.com and anagh@stellarisvp.com

We’d also love to hear suggestions, thoughts, or any divergent views on the points we have highlighted in the blog post; you can reach out to Era or Anagh.