While the initial idea of speaking to people in the gaming industry was to validate a hypothesis: Building a casual gaming studio from India for the world is a large opportunity (covered in Part I), those conversations proved way more fruitful than we imagined. Not only did we learn about the process of building a gaming studio but qualitative insights on industry trends, skills required in a team, and nuances of execution stood out.

We acknowledge that entrepreneurs, with their profound understanding of the industry, are best equipped to determine the optimal approach to building. However, we thought that a primer outlining the building blocks of a studio business could be beneficial for those embarking on a new venture in the field.

Prior to establishing a gaming studio, founders must determine the genres of games they intend to pursue. There are multiple approaches to streamlining the selection of genres or themes for the fundamental gameplay. Let’s dive deeper.

Genre Identification

When building a game, one approach is to innovate & come up with entirely new core game loops or gameplay mechanics to create a differentiated gameplay experience for the player – however, that approach is rarely adopted. While it reaps the largest rewards if the outcome is favourable i.e. if the new mechanic sails well with the players, it comes with a high risk of failure given the uncertainty of user response to the new game mechanics.

The other & more commonly adopted approach is “fast-follow”. Game developers mirror proven core & meta loops (like Match-3, Merge, Hidden Objects etc.) & introduce incremental innovations to create slightly differentiated game experiences. These delta can come in the form of new storylines, meta loops, social features, in-game economies, characters, 10x better tech/UX, richer graphics or effects, etc. Playsimple is a proven success of this model which built global word games from India, disrupting legacy players and snatching top spots in global charts. Word Trip & Crossword Jam by Playsimple rank in top 5 grossing games in the Word sub-genre.

Core Loop: Series or chain of actions that is repeated over and over as the primary flow of your players experience. E.g. Matching 3 tiles in a Match-3 Candy Crush game.

Meta Loop: Systems and mechanics that wrap the core gameplay. Their intent is to provide long-term goals for players to engage them for a longer period of time. E.g. Gardenscapes (a popular Match-3 game) has the meta-loop of unlocking more story content and renovating player’s home town as the game progresses.

Limiting our focus to the fast-follow model, we believe there could be whitespaces in multiple genres for new games to be built. These genres could be identified by looking at the following factors:

- Large genres ($100M+ in revenue) & seeing double digit CAGR in the last 3 years

- Concentration of value captured by a few games i.e. >50% market share held by 2-3 games

- Identifiable gaps in player experience – scope to improve user engagement & retention through delta in meta loops

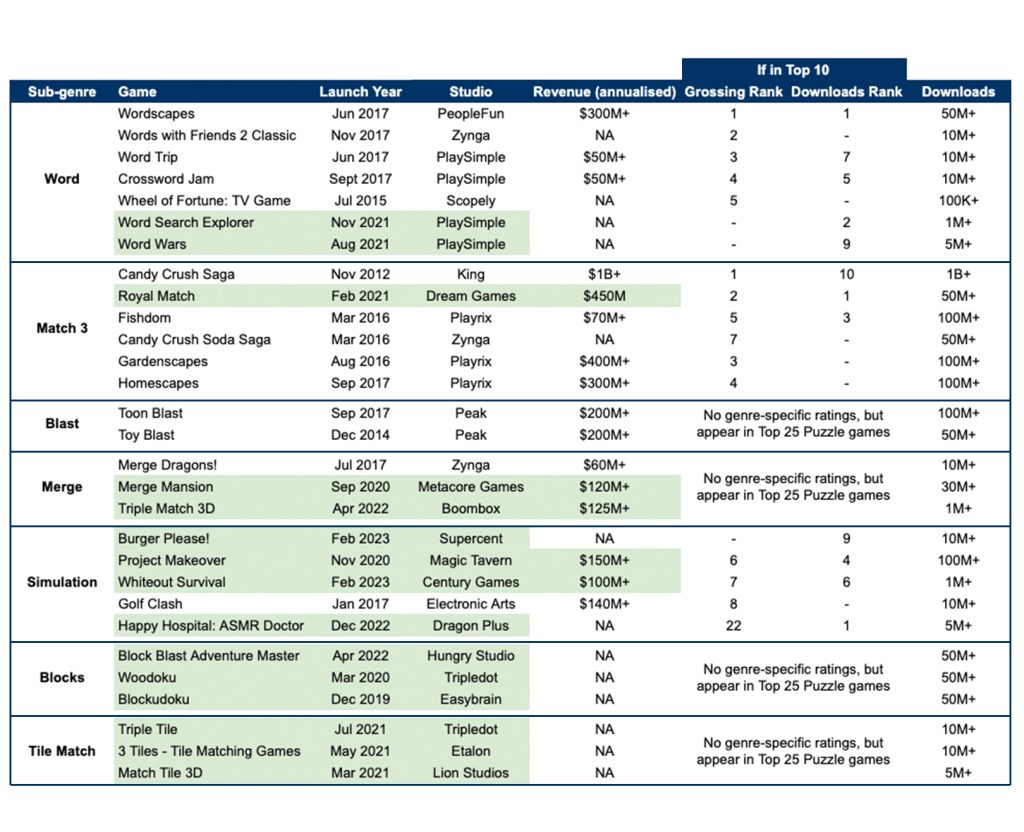

Below is an exhibit showing the success of fast-follow strategy seen across sub-genres of Puzzle games where:

- At least 15 new games (green) released in 2019-23 have displaced legacy games to rank in Top 10 charts by revenue or downloads in the specific sub-genre

- 5 games by 5 different studios (revenue in green) have scaled to $100M+ ARR via 1-100M downloads in <3 years of launch – 3 of them on the back of pure-play fast-follow

Success of fast-follow strategy seen across sub-genres of Puzzle games

The fundamental gameplay mechanics for all games within each category are nearly identical. Yet, the newly launched games have been able to reach a similar scale as incumbents primarily through innovating on meta loops.

Once the genre is finalized, it’s time to start building the game. And a studio requires building not one, but multiple games in succession.

Execution Playbook

The process of building a gaming studio is a well discovered one – conceptualisation followed by concept testing through short ads, building a prototype for beta testing, soft launching & finally scaling the game.

The key determinant of success remains identifying an interesting gameplay (core+meta loop) that would hit the right chord with the players. This is fairly intuition-led, often arising from the game developers’ experience/personal instinct. Once a game demonstrates early traction, scaling it up is largely a data-led process.

Knowing whether the game is headed in the right direction and if it merits marketing investment requires meticulous analysis of data. Game developers monitor 4 key metrics during the early days –

- Growth of users (DAU, WAU, MAU)

- Engagement time

- Retention

- LTV/CPI (lifetime value of customer/cost-per-install)

Based on our conversations, we’ve identified below benchmarks for a casual game. These could vary by the game genre and target markets.

- DAU/MAU (measure of stickiness) of 20-30%

- Engagement time of 20-30 mins/day per user

- D1, D7, D14 retention of 40%, 20%, 10% respectively

- LTV/CPI of 1.2-1.5

In gaming, experimentation in the early stages is crucial. Once a game is designed, it is tested with a small group of beta users to gauge if benchmark metrics, such as D0 session time & D1, D7 retention, are met. If yes, game developers proceed with a soft launch. If not, they usually end up iterating or killing that game and moving on to building the next game.

Gaming is probably the only space in consumer-tech where global GTM (User Acquisition) can be done solely by leveraging data-led insights, instead of gathering softer consumer behaviour insights. This makes a case for building a global game studio remotely, even from India.

Identification of genres and scaling up games is important, but what’s also essential in most consumer businesses and more so in gaming, is staying abreast of industry trends. You don’t want to be building an outdated Match-3 game with no storyline or social meta when the world has moved on to a castle restoration narrative with decorative and character meta Match-3 game.

Latest Industry Trends

Mobile gaming ecosystem is evolving rapidly, with the market producing new innovations in response to changes like ATT (App Tracking Transparency) and post-covid player behavior. It’s highly advisable for game developers to closely monitor changing trends in the industry before developing a strategy for their studio.

Casual games employing mid-core style retention & monetization features

- Hybrid core and meta layers are becoming increasingly popular among top-grossing games

- In the quest to improve player retention & engagement time, casual games are building meta loops in the game – for instance, you might have noticed that the game ads you see on Insta are nowhere close to the actual game if you end up installing & playing it. It’s just a side mini-game to engage you in earning coins to support the core gameplay

Changing genre dynamics & popularity

- For instance, Match-3 games are facing a saturated market. Garden Affairs and BTS Island are the only successful traditional Match-3 games released in the last 2 years

- Merge games is the rising subgenre to watch, increasingly becoming popular because developers can combine their straightforward gaming mechanics with more sophisticated appeals to the narrative

- Games are attracting new audiences through the innovative combination of various game genres and mechanics. Eg. Fiona’s Farm found success by combining 2 major casual subgenres, Match 3 and Tycoon/Crafting

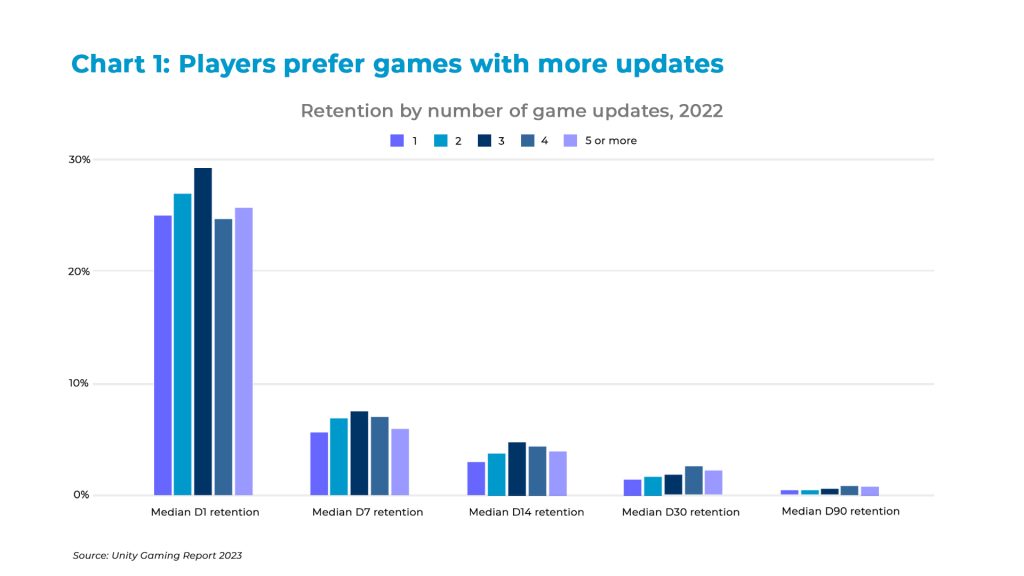

LiveOps is no longer a choice, but a necessity

- Live Ops, or updating games frequently, is a key monetization and retention strategy for top grossing games, attempting to maintain long-term player engagement and spending. Top 10 revenue generating mobile games globally since 2022 supported their titles through LiveOps.

- LiveOps can include front-facing technical improvements and even backend enhancements that the players don’t see. In general, games with more updates have better D30 and D90 retention.

- Achievements and challenges are the most common ways to engage players. Leaderboards, daily rewards, events, social features, modding are others.

Finally, successfully navigating the intricate ideation and execution demanded by the gaming industry necessitates assembling a team of individuals possessing relevant skills and expertise.

Team Building

Beyond the essential qualities that are fundamental for an effective founding team in any business, there are specific capabilities that could be particularly crucial for a gaming team

- Highly experimentative & iterative mindset to game-building

- Long gaming background or “grey hair” – helps significantly in 1) hiring rich talent from their existing network & 2) understanding nuances of various functions of a gaming org – Design, Product, UA, Monetization, P&L

- Growth orientation, but with clarity i.e. stepping up growth only after LTV visibility, and backing down when the game fails to get traction

- User Acquisition muscle – essential for the 0-to-1 & 1-10 journey of the game

- Strong data orientation – as scaling up a game is all about being able to extract & act on sharp insights from data

With that, we wrap our two-part blog series of the casual gaming studio opportunity. We would love to hear feedback and/or exchange thoughts on the space. If you’re building in gaming, we’re pumped to talk to you. Please reach out at rupali@stellarisvp.com.