Climate change is increasingly being seen as the most important problem facing us at the moment. Extreme weather events are occurring more frequently e.g. heatwaves and droughts are 2.8X and 1.7X more likely, respectively, as compared to a 1900 baseline. Their impact is also getting more and more visible – in the past few months we have had flooding in Bangalore, unprecedented heat waves in Europe, people risking life and limb for access to water in Madhya Pradesh – and is expected to get worse over time.

Fighting climate change i.e. helping keep global warming to within 1.5C of pre-Industrial era levels, is a daunting problem owing to three key reasons.

- One, there is no silver bullet. It is necessary to attack multiple problems simultaneously, and climate interventions cover an incredibly wide spectrum (more on that below).

- Two, there is a limited window of time before damage to the planet is likely to be irreversible.

- Three, much of climate tech is likely to involve solving problems of atoms instead of bits, including many that have not been solved before. This often involves fundamental research and physical deployment, both of which are time and capital consumptive.

However, these reasons also make climate tech an extremely attractive problem space.

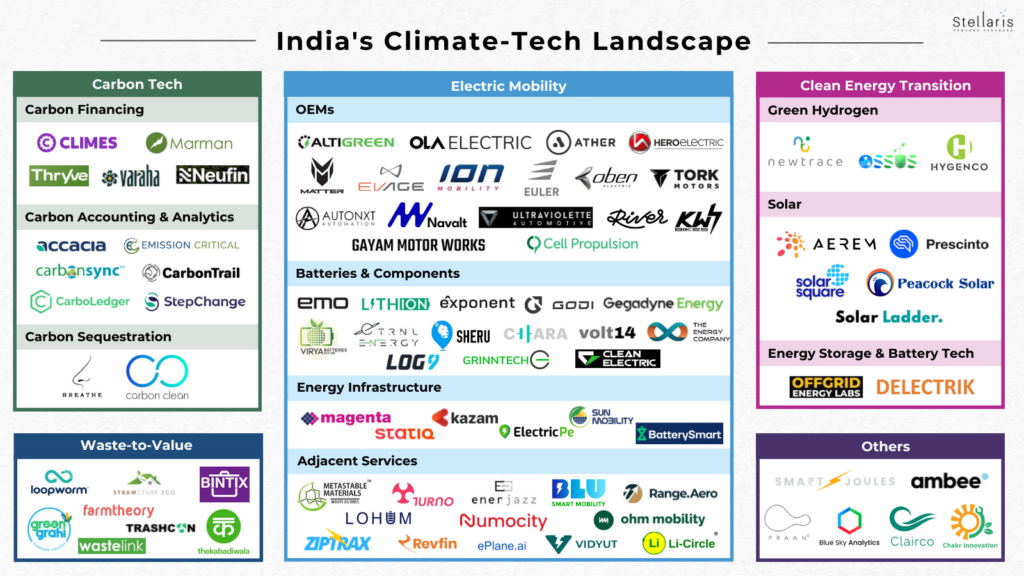

- The lack of a silver bullet means there are multiple problems to solve, and multiple opportunities to invest. Climate action is a vast topic, and the gamut of interventions spans areas as diverse as reducing energy consumption in buildings, novel energy storage techniques, electric transportation, software to improve operations of renewable energy assets, new instruments to finance climate interventions, reducing GHGs from industrial processes, carbon sequestration, and more.

- The limited window of time drives urgency, and will reduce barriers to adoption. Also, while the window for irreversible damage is finite, the time it will take to actually mitigate the impact of climate change is far longer – we are unlikely to meet climate goals before 2050 – making climate tech a secular and extremely long-term opportunity.

- Deep tech solutions, when done right, have incredible moats and large outcomes. They also create ecosystems of adjacent businesses which can present attractive investment opportunities as the core technology matures.

The urgency of the problem has also led to policy tailwinds, globally. The Inflation Reduction Act grabbed (IRA) headlines – and rightly so – recently for the scope of its ambition; arguably more importantly, however, it is worth noting the IRA is part of a global trend of favourable regulation across both developed and emerging markets.

It is hardly surprising, then, that climate tech is at a tipping point. The range of solutions that are good for the planet and good for the bottom line is growing everyday – electric mobility and renewable energy are already going mainstream. We are starting to see commensurate momentum globally in financing climate interventions. Private equity firms mopped up more than $100B of dry powder for climate dedicated vehicles between 2019 and 2021. In the same time period, annual VC dollars into climate tech grew from ~$15B to ~$37B. It is estimated that $1.5 to $2 trillion of capital will be deployed annually in climate interventions by 2025.

Progress in emerging markets, in general, and India, in particular, will be key in the fight against climate change. As a nation, we will have to balance the twin goals of economic growth and sustainability. This is likely to involve technological leapfrogs, local innovations, and concerted action by a variety of financial and policy actors. As I have spent more time understanding this topic, I have been pleasantly surprised with the vibrancy of India’s climate tech startup ecosystem. Talented teams are attacking hard problems every day, and we continue to be impressed by their capability and ambition levels.

We believe a slew of large companies will emerge as the fight against climate change goes mainstream. Opportunities – both in the Indian and global markets – exist, and will continue to exist, for Indian climate entrepreneurs. We have taken the first step towards supporting them with our investment in Turno, and look forward to partnering with many more great teams in the future. If you are building in this space, or just want to share notes over a coffee (or two), please drop me a line on arpit@stellarisvp.com.