EVs will redefine the automotive, energy and mobility industries at their core. The structural advantages of EVs are hard to ignore. Yet, there is scant reflection of this wave in India. We discussed in our last article why it is hard to stop the EV tsunami and despite that why India has little to show at present.

Short Term

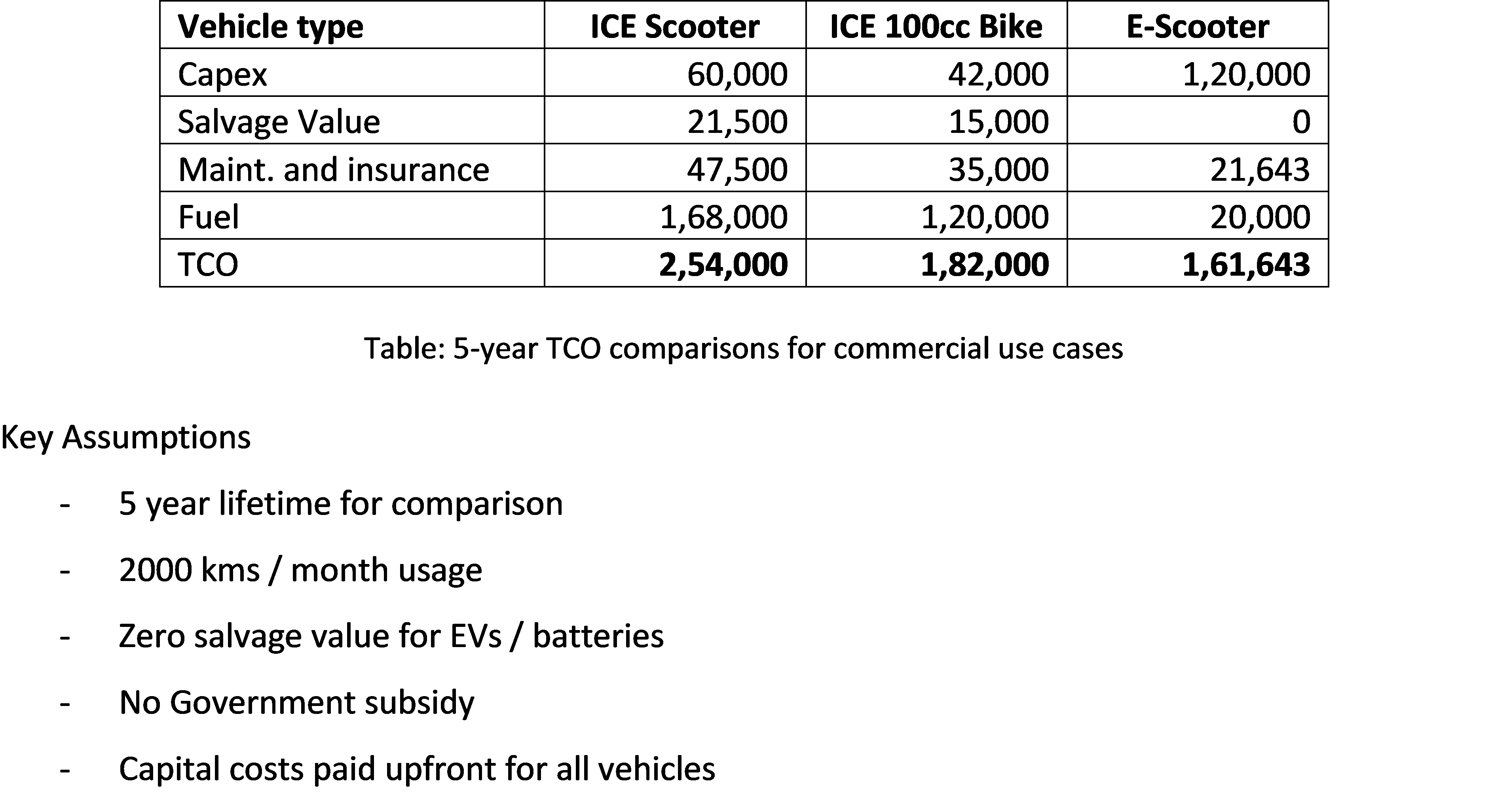

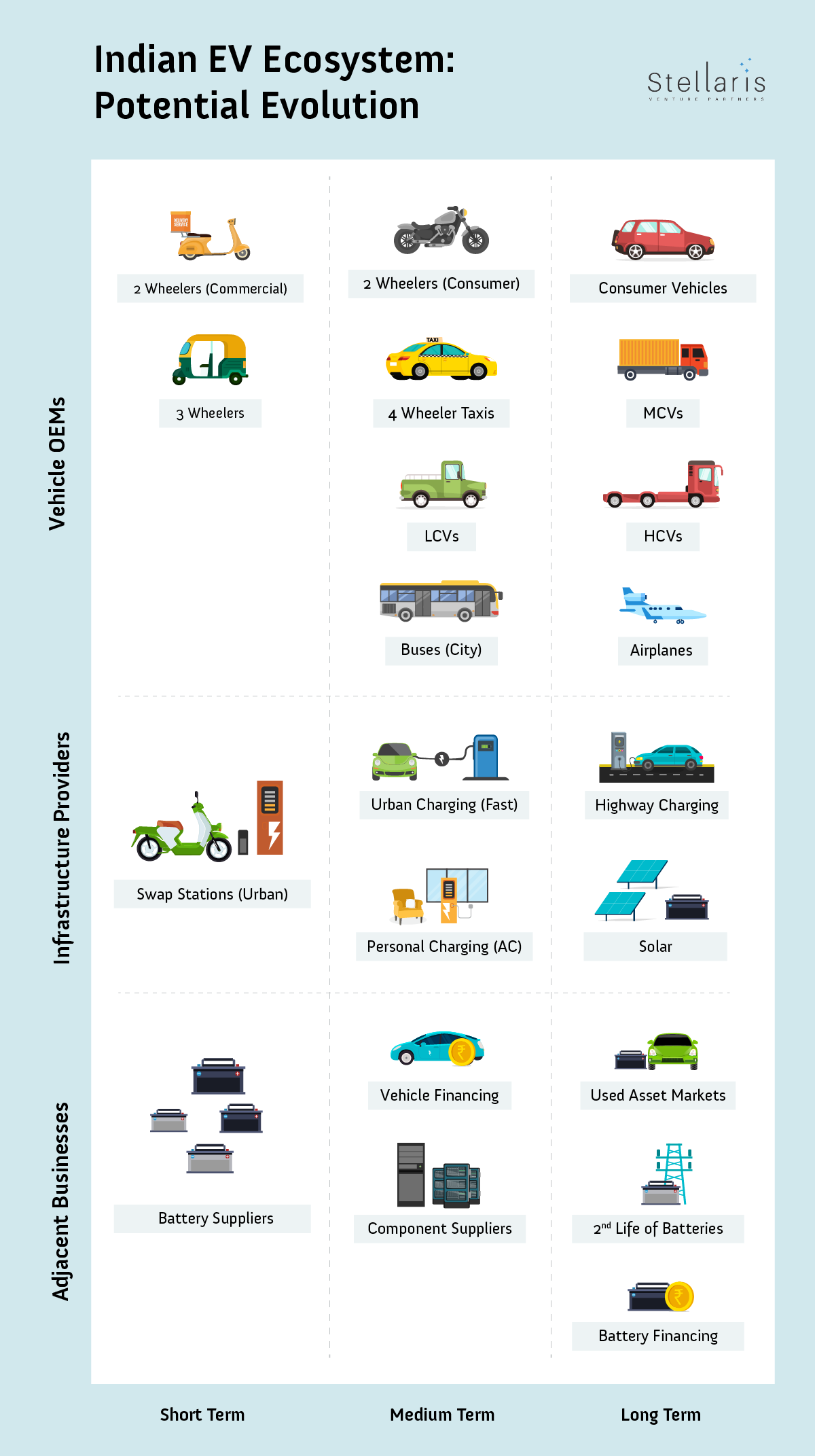

In the short-term, we expect mass market adoption to be led by two-wheelers and three-wheelers, specifically for commercial applications, where the TCO economics work out favourably for EVs. We compared TCOs for an ICE scooter (such as an Activa), a 100 cc bike, and a hypothetical e-scooter, for consumer and commercial use cases. The results for the commercial use case are shown in the table below.

Without financing costs and with conservative assumptions, an e-scooter’s TCO is lower than competing options for commercial use cases. Given the importance of vehicle running costs for commercial operators – a typical 2W rarely runs more than 20-30 kms per day for a consumer but can often run more than 100 kms per day when being used commercially, translating into daily savings of INR 150 – we anticipate EV adoption to take-off rapidly in this segment. We spoke with several delivery providers / fleet operators on the topic, and each of them was willing to place sizeable orders for a quality product. It is important to note that the absence of a deep financing ecosystem for these vehicles is not a concern, given the extremely high savings on opex, and most large players are willing to finance the first set of vehicles off their own balance sheet to get the ball rolling.

For consumer use cases, an e-scooter’s TCO is ~40% higher than an ICE scooter, and close to 2X for an entry level 100 cc bike. Also, consumer use case will require 3rd party swapping or charging networks, which may take time to evolve given the ‘chicken-and-egg’ nature of the problem there. Finally, a consumer business also involves significant brand-building and distribution, and hence we do not see it taking off before the commercial business in the short run.

The conclusions of an analysis for 3W comparisons are also similar, but it is better to look at results on the ground in this case. India has 1.5M+ e-ricks on the road today, more than the total number of electric passenger cars sold in China since 2011. In addition to the economics, the vehicle’s form factor – which allowed for initial traction through lead-acid batteries which are well understood in India – also supported rapid take-off. Other structural factors for take-off have been the lack of registration requirements for this category, the easy availability of cheap Chinese imports, and the presence of ~2000 assemblers all across the country.

Two other spaces have shown initial indications of EV adoption.

- The first is buses, with the Himachal Pradesh Government running a pilot with 200 buses to be deployed in a phased manner, and several municipal-level tenders in the works. EVs make eminent sense for buses – these are assets which are often used for decades, typically run a few hundred kilometres each day, have predictable routes, and State-run transport entities enjoy low costs of capital. While there is a significant market for private bus operators in India, we believe adoption here will be driven predominantly by the actions of the State.

- The second is 4W e-taxis, with dedicated players emerging in both Bangalore and NCR. Here, Ola’s recent deal with Hyundai and Kia can be a significant, leading to critical mass for this segment to take off. However, we have questions around this segment’s immediate viability. One, owing to the unviability of swapping, ubiquitous fast-charging is the only charging option which ensures sufficient vehicle utilization. That requires power companies to manage extremely high grid loads, and has a negative impact on battery life. Two, battery costs will continue to be sizeable, and a shorter life will increase effective battery costs even further. As a result, while there is some initial traction, we expect true take-off to only happen in the medium term.

Given the short-term market will be driven predominantly by commercial use cases, we expect swapping to be a major source of energy replenishment for Indian EVs. Globally, swapping has not taken off at scale – GoGoRo in Taiwan being a notable exception – and Better Place in Israel was a spectacular debacle. However, the current Indian situation is different owing to the following reasons – swapping has an economic value for commercial users, as opposed to only a matter of convenience; owing to increased energy density, battery packs are much more amenable to be managed by an average person; as opposed to 4Ws, the physical design of 2Ws / 3Ws is suitable for swapping, and the Indian vehicle market is dominated by 2Ws and 3Ws. Swapping also allows reduction of battery size thereby reducing upfront capex, which is a critical success factor for Indian buyers.

Medium Term

In the medium term, we expect 4W EV adoption to be driven by taxi operators, and consumer use cases for 2Ws to start taking off, along with early development of associated businesses. Taxi operators will fuel the growth of higher capex fast-charging networks, with consumer 2Ws leading to the growth of lower capex AC-charging, often through portable home chargers or through charging points at residential / office locations. Riding on continuously reducing costs and high penetration of urban charging infrastructure, LCVs are likely to go electric. We expect the financing ecosystem to deepen, with sufficient data points for lenders to evaluate a different underlying asset; as well as the emergence of specialized component manufacturers.

A short note on mobility, which we had alluded to earlier in our post. We have already seen that the economics of a scooter-sharing business – where the fixed cost of a driver is no longer borne by the service provider – are fundamentally different to other modes of urban transport. EVs will make the economics even more compelling, and help accelerate the shift towards shared mobility in urban areas.

As we increase the time horizon of our crystal ball gazing exercise, the best we can do is generate potential scenarios based on informed speculation. The evolution of the market will depend on a variety of factors such as Government policies, actions of incumbents, the flow of investment capital, and developments in technology. Precisely, each of these is hard to predict; directionally, however, there are some clear signs – we are confident that Government policies will be favourable for the sector, that all existing incumbents have the intent to capitalize on the EV opportunity, that significant investment capital will flow into the segment, and that battery technology will continue its rapid evolution.

Long Term

In the long term, therefore, we see a very different future for the automotive, energy and urban mobility industries.

Needless to say, all current vehicle types will predominantly be electric, including passenger cars and HCVs. Globally, work has even started on short range electric planes, as reflected in our infographic above. While a long shot, electric air travel is not outside the realm of possibility. Vehicles are likely to be disaggregated – even in the minds of the end user – into the mechanical vehicle structure and the battery pack, leading to an additional fundamental building block for the industry. In addition to vertically integrated OEMs, specialized niche – which is not to say small – OEMs will exist, and thrive, for each product. Separate used asset markets will exist for vehicle structures and battery packs, which have a significant second life in less demanding stationary applications. Similarly, vehicle structures and battery packs will also have independent financing ecosystems.

In the steady state, the marginal cost of mobility is likely to be negligible. With high quality research underway into other promising, and reusable, battery technologies such as fuel cells, it is unlikely that Li-ion will be the dominant battery technology in the long run. Also, owing to intersecting developments in solar, decentralized renewable energy generation networks could account for a large share of mobility’s energy requirements, with EVs potentially acting as micro-grids when not in use.

Urban mobility will be predominantly shared, which will lead to a tighter integration between mobility providers and vehicle manufacturers, and a high component of B2B sales in an industry which has hitherto been built around a distributed consumer sales model. This could also lead to manufacturers delivering customized vehicles for customers who place bulk orders, a trend that we have seen even at this nascent stage of the market’s evolution. Or, the difference between OEMs and mobility service providers may blur completely. Ola’s entry as an OEM is already a sign in that direction. It may happen the other way around as well!

Investment Opportunities

At present, we see a rare – and admittedly difficult – opportunity for the creation of a new OEM, especially for 2Ws / 3Ws. This is a segment ready for take-off, as confirmed by our conversations with logistics players and fleet operators, and can thus provide the initial critical mass that a new player would need to survive; creating a high quality product – as opposed to a prototype – is not an easy task, leading to high entry barriers; the overall engineering complexity and capex requirements for manufacturing in this segment are not as sizeable as they are for 4Ws and beyond, where they are at least an order of magnitude higher; and leading via B2B sales provides an opportunity to build the business in a capital-efficient fashion before hitting the B2C markets.

We also feel that replenishment solution providers – swapping as well as charging networks – present interesting investment opportunities. In addition to the challenges inherent in running physical networks, there are specific challenges worth highlighting for each of these businesses. Swapping providers need to get as many OEMs to agree to their battery standards as quickly as possible. They also need to maximize lifetime value for their underlying asset, the battery, especially once it is no longer useful for mobility applications. Charging networks are more likely to handle unpredictable demand patterns, and hence need to rapidly establish high density in geographies of operation. As such, availability of capital will be critical for these businesses.

As the market evolves and sub-markets develop, we expect several more interesting opportunities to start coming up. Staying agnostic to underlying technologies will enable rapid scaling and defensibility for these businesses.

Conclusion

We have found our EV journey to be an exhilarating ride so far, full of learning and an ever-increasing appreciation of the magnitude of change that is around the corner. As investors, we have also seen Indian start-ups to be predominantly led by business model innovation rather than core technological innovation. The EV space presents a rare opportunity to build a fundamental technology driven company in India, with enough depth in the Indian market to lead to large business outcomes. It’s heartening to see entrepreneurs looking to solve hard problems across areas such as vehicles, battery packs, new battery chemistries and chargers. We have been privileged to have had the opportunity to dive deeper into some businesses, and would love to partner with the right team on their EV journey. In case you are looking to build the next big thing in this space, please drop us a line on arpit@stellarisvp.com or alok@stellarisvp.com.