Introduction

Having met dozens of companies in the space so far, we are not exaggerating when we say that we believe electric vehicles (EV) to be a once-in a-generation technological shift with massive ramifications – for businesses as well as society; consequently, it can also present attractive investment opportunities.

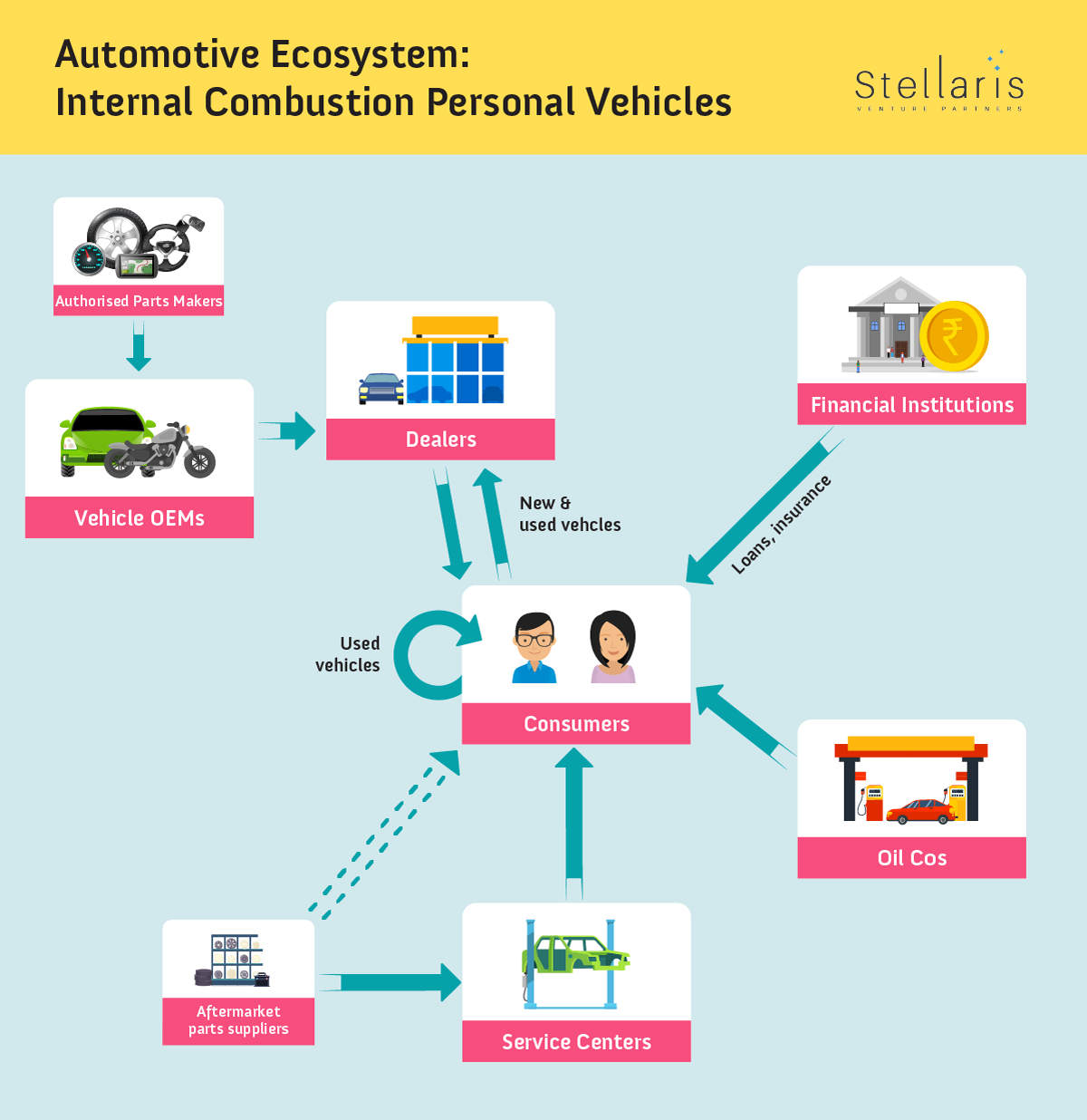

Historically, the first automobiles were electric, before innovations across the board made the advantages of fossil-fuel technology overwhelming. The result is one of the largest industries in the world, with vehicles alone contributing 3.5% of global GDP and 7% of India’s GDP. The current automotive industry – including not just internal combustion (IC) vehicles but also energy – is massive, and composed of several large sub-industries, as shown in the graphic below.

We believe EVs, in their currently emerging form, can alter – either materially or fundamentally – each of these constituent markets, and the overall automotive industry at an aggregate level. As a result, EVs can also lead to structural changes to a closely associated industry – mobility.

What’s the big deal, anyway?

As the name suggests, EVs use electricity as their power source – the electricity generation happens through batteries utilizing a range of underlying chemistries, with Lithium-ion (Li-ion) being the most popular – as opposed to combustion of fossil fuels in traditional vehicles. Since their powertrain is electric and not mechanical, they also have much fewer moving parts – close to 1/10th for 2Ws – as compared to IC vehicles. As a result, EVs have dramatically reduced running costs – the energy cost per km for Li-ion 2W EVs in India is 1/10th that of their IC counterparts, and they need much lower mechanical maintenance.

Despite these advantages, EVs have yet to go mainstream for two critical reasons:

- high upfront costs for battery packs on the one hand leading to unfavourable total cost of ownership (TCO) economics

- low energy density of battery packs, thus limiting the distance a vehicle can travel on a single charge, leading to range anxiety

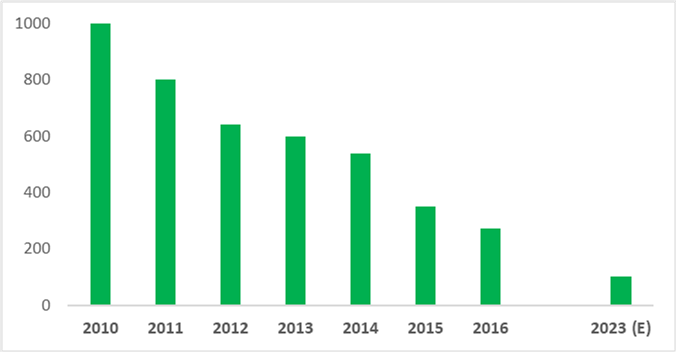

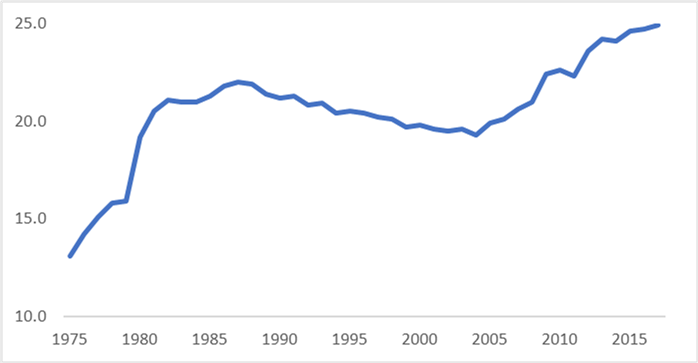

However, recent developments in each of these areas, as shown below, have been extremely favourable for EV adoption. Battery pack costs, as high as $1000/ kWh in 2010, are now approaching $200/ kWh. Considering that batteries are ~50% of the cost of the overall vehicle even at today’s prices, EV prices have fallen by 2-3x in less than a decade. IC vehicles, on the other hand, have approached their asymptotic limits of efficiency. There are also significant increases in energy density for battery packs – volumetric energy density has almost doubled since the turn of the century, leading to more energy – and hence more distance driven – for the same weight, ameliorating range anxiety concerns.

Rapidly falling battery pack costs

Battery pack costs in USD / kWh

IC Vehicles close to maxing out on their efficiency limits

Fuel efficiency of IC vehicles in miles per gallon. Data from USEPA

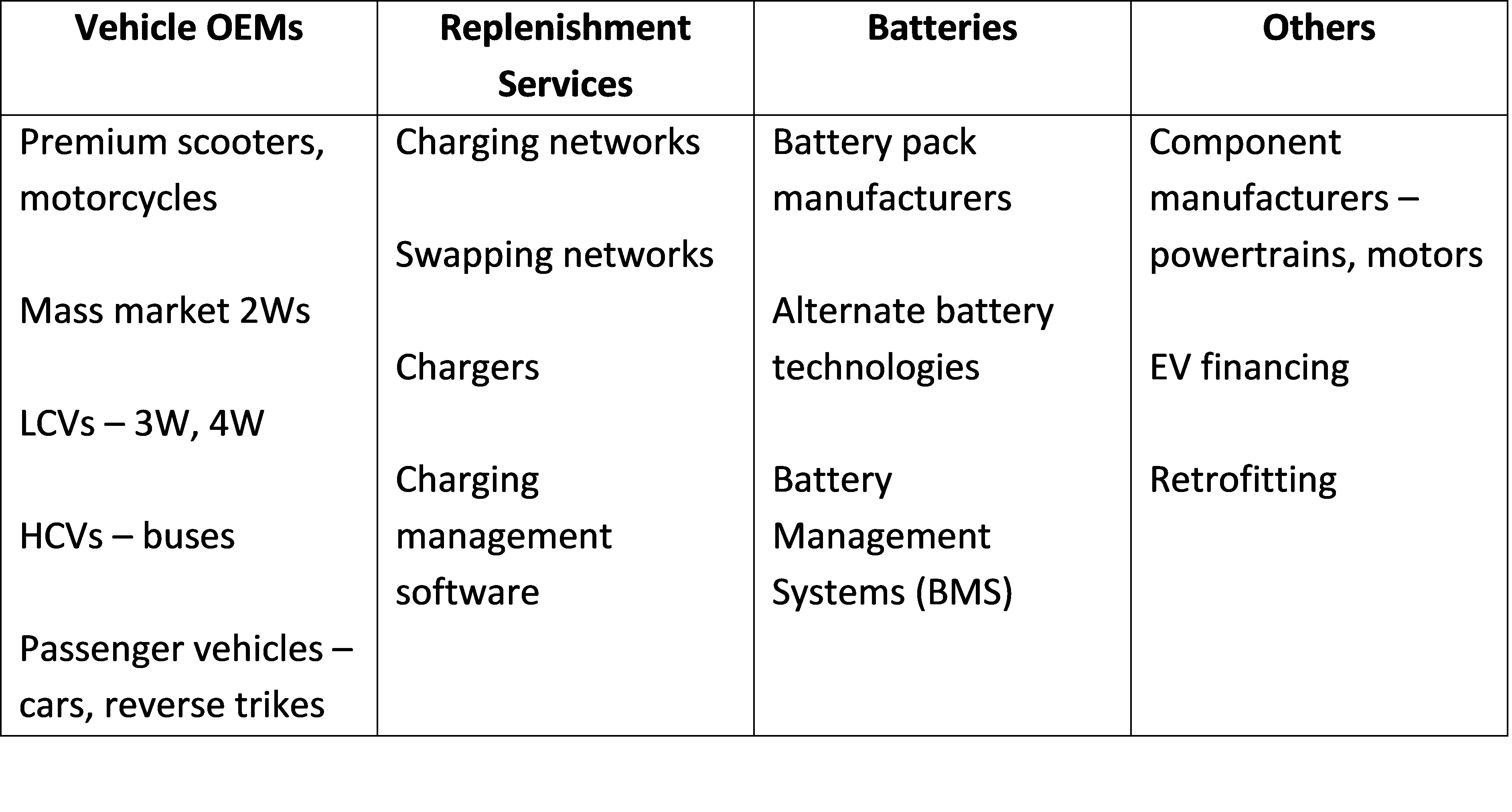

Net-net, EVs are close to taking off, and we see the building blocks of the industry – vehicles, energy replenishment infrastructure and batteries – getting in place. The same is reflected in the types of businesses emerging in the market; in addition to vehicle OEMs, most businesses we have seen are within the domains of energy replenishment services and batteries.

Consequently, EV adoption in China has grown exponentially – from a minuscule number in 1998 to ~30M 2Ws sold annually in 2018, and an ~100X growth between 2012 and 2018 for electric car sales.

Is India Ready?

This is a multi-billion dollar question!

We are optimistic, because the fundamental economic advantages of EVs are hard to ignore for the government as well as private players. That said, we find many constraints today. To enumerate a few:

- Many players are taking short cuts of copy-paste from China. This may not work as battery performance at Indian temperatures deteriorates significantly. Real R&D is required for making products that run seamlessly in Indian conditions

- There are hardly any quality OEMs. Most OEMs we have met are treating this as a lab project, forgetting that there is a reason why automobile design and testing cycles are so long – vehicles need to last 5-10 years or even more

- Charging (or swapping) infrastructure is expensive to build with its own chicken and egg issues. Charging infrastructure – and especially fast charging – may require massive changes in the electricity transmission network

- Vehicle financiers are sitting on the fence as there are no reliable vehicles; and even if there is a promise from some OEMs, there is no long-term performance and resale data to underwrite these vehicles

- Stable government regulations and meaningful subsidies will be critical to kickstarting the process

Given these challenges – where do we begin? Stay tuned for the sequel!